Deciding to rent or buy is a major financial choice. Here’s a simple look at the numbers in the St. John's housing market to help you decide.

Interactive Rent vs. Buy Calculator

Adjust the numbers below to see how things could work out for you.

Buy

Rent

Renter's Investment

Market Assumptions

Find Your Perfect Home in St. John's

Browse Rentals in St. John’s

Explore comfortable and affordable apartments, condos, and houses available right now.

View all Houses for Sale St. John’s

Check out the latest listings to find the perfect place for you and your family.

Search St. John's Condos

Discover modern, low-maintenance condos in prime city locations.

In This Article

The St. John's Real Estate Market

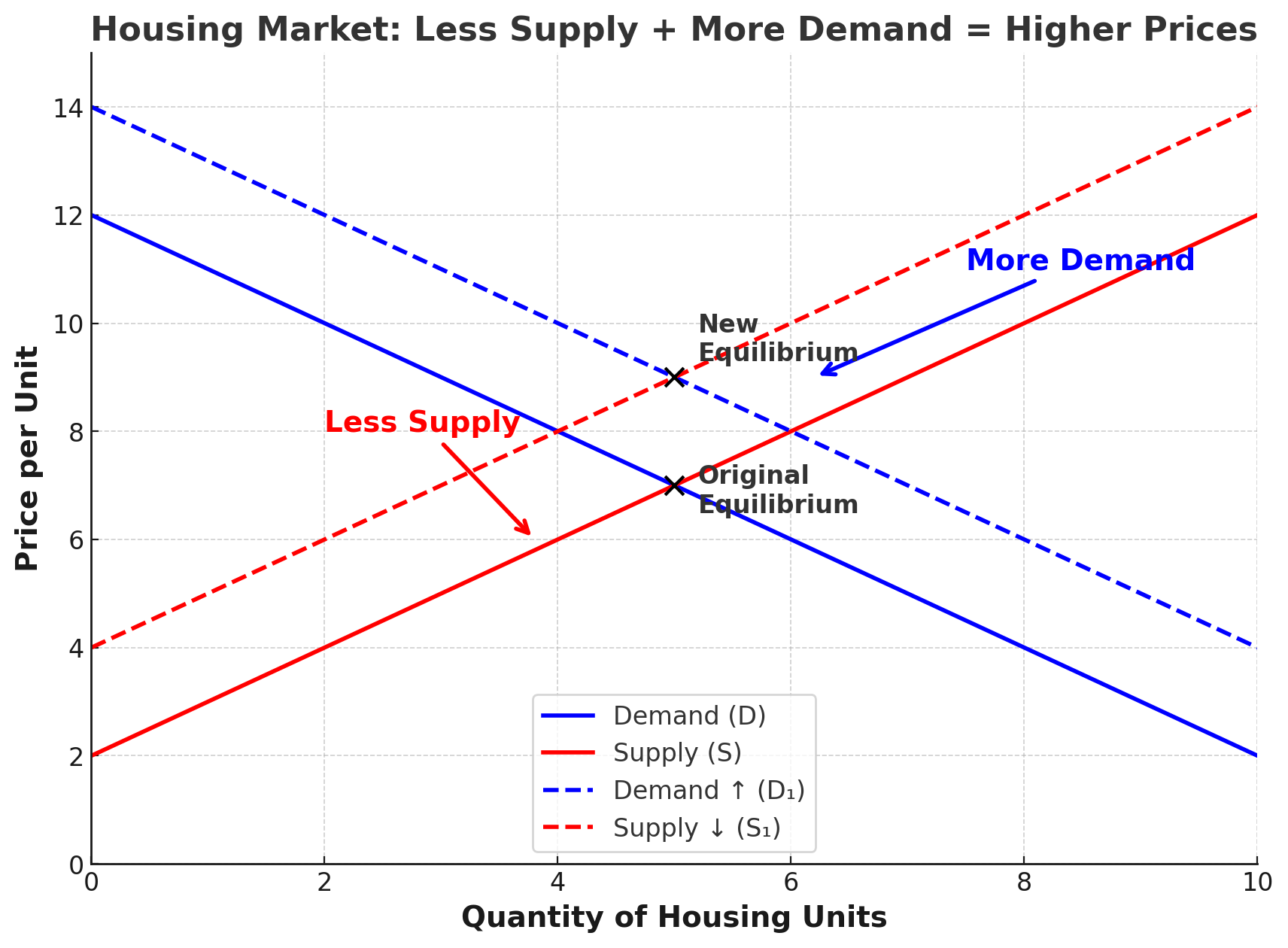

To decide between renting and buying, you need to understand the St. John's real estate market. The city is changing fast. A severe shortage of homes and high demand mean prices are rising and likely to keep going up.

The Supply Problem

There aren't enough homes for sale in St. John's. This isn't a short-term issue.

- Low Inventory: The number of homes for sale is at a 20-year low. This means it's a "seller's market," where prices are pushed upward.

- Tough Competition: With few homes available, buyers face fierce competition. Properties sell quickly, often with multiple offers driving the price well above asking.

The Demand Boom

While supply is low, demand for housing in St. John's is booming.

- Population Growth: Newfoundland is seeing record numbers of people moving to the province, putting huge pressure on the housing market.

- Strong Economy: A healthy local economy, driven by oil and a growing tech sector, creates jobs and attracts new residents.

- Outside Investors: Buyers from more expensive cities like Toronto and Vancouver are investing in St. John's, making the market even more competitive.

Price Trends

This mix of low supply and high demand has led to big price increases.

- Recent Growth: Home prices in St. John's have seen double-digit growth. The benchmark price for a single-family home rose 12.5% in the last year to $405,100.

- Future Outlook: This trend is expected to continue, with experts predicting another 11% rise in average home prices next year.

In this market, a "two-apartment home" is a smart buy. It allows an owner to use rental income to help pay their mortgage, making homeownership more affordable.

The Costs of Renting

Renting is often seen as flexible and cheaper in the short term. But it's important to look at all the costs involved, not just the monthly rent payment.

Monthly Expenses

As of August 2025, the average rent in St. John's is about $1,266 per month, but this changes based on the apartment's size.

- Studio: Around $1,155/month.

- One-Bedroom: Around $1,266/month.

- Two-Bedroom: Around $1,451/month.

- Three-Bedroom: Around $1,500/month.

Other Rental Costs

Your monthly rent is just one part of your total expenses.

- Security Deposit: Landlords can charge up to 75% of the first month's rent. You get this back when you move out, but it's an upfront cost.

- Utilities: Most rentals in St. John's do not include heat and electricity. These bills can range from $60 in summer to over $200 in winter.

- Tenant Insurance: This is highly recommended to protect your belongings and is usually not very expensive.

Rental Market Outlook

The rental market is also very competitive, which affects renters financially.

- Rising Rents: Rents have gone up by an average of 4.9% in the last year.

- Low Vacancy: It's getting harder to find a rental, as fewer places are available.

The Costs of Owning a Home

Owning a home involves more than just a mortgage payment. To compare it fairly with renting, you need to look at both one-time purchase costs and ongoing expenses.

Part 1: Upfront Costs

This is the cash you need to buy the home.

- Down Payment: The minimum down payment depends on the purpose of the property.

- For a Primary Residence (the home you will live in): You need at least 5% of the purchase price. If your down payment is less than 20%, you'll also need mortgage default insurance.

- For an Investment Property (a home you plan to rent out): The minimum required down payment is 20%.

- Mortgage Default Insurance (CMHC): This insurance is required for primary residences with a down payment under 20%. You must pay the 15% sales tax (HST) on this premium in cash when you close the deal.

- Closing Costs: Budget 1.5% to 4% of the home's price for things like legal fees and inspections.

| Expense Item | Approximate Cost (CAD) |

|---|---|

| Legal Fees & Disbursements | $1,000 – $1,800+ |

| Home Inspection | $250 – $700 |

| Property Appraisal | $300 – $600 |

| Title Insurance | $250 – $400 |

| Land Survey | $1,500 – $6,000 |

| Adjustments (Taxes, Utilities) | Varies |

Part 2: Ongoing Costs

These are the monthly and yearly expenses of homeownership.

- Mortgage Payments: Your largest expense. Part of it pays down your loan (building equity), and part of it is interest (a cost).

- Property Taxes: In St. John's, this includes a property tax and a flat water tax.

- Home Insurance: Newfoundland has some of the lowest rates in Canada, averaging about $65 per month.

- Utilities: Electricity can be a major cost, especially for heating. Bills can range from $200 to $450 per month on average.

- Maintenance: This is a key cost. A good rule is to save 1% of your home's value each year for repairs and replacements (like a new roof or furnace).

Comparing Renting vs. Buying

Now let's compare the numbers to see which option makes more financial sense over time.

The Break-Even Point

This is when owning a home becomes cheaper than renting. In St. John's, with home prices and rents rising, the break-even point is about 5-7 years. If you plan to stay longer than that, buying is likely the better financial choice.

Real Estate vs. Stock Market

What if a renter invested their down payment money in the stock market instead?

- Real Estate Returns: When you buy a home, you benefit from the price increase of the entire property, not just your down payment. This is called leverage. Plus, any profit from selling your main home is tax-free in Canada.

- Stock Market Returns: A renter could invest their money and earn returns, but these are not guaranteed and any gains are usually taxed.

10-Year Financial Projection (Rent vs. Buy)

This chart shows the potential financial outcome of renting versus buying over a decade.

Assumptions:

- Buy: $405,100 home, 10% down, 4.5% mortgage.

- Rent: Starting at $2,200/month, with a 4% annual increase.

- Renter's Investment: The renter invests their down payment money and earns a 6% annual return.

Other Factors to Consider

While the numbers are important, other things can change the math, and personal factors matter just as much.

Help for First-Time Home Buyers

Saving for a down payment can be tough. Luckily, government programs can help. See our full First-Time Home Buyer Guide for details.

- NL First-Time Homebuyers Program: This provincial program can provide a loan of up to 5% of the purchase price, with no payments for the first five years.

- Federal Home Buyers' Plan (HBP): This lets you withdraw up to $60,000 from your RRSPs for a down payment, tax-free, as long as you pay it back over 15 years.

You can often use both programs together, which makes buying a home much more achievable.

Lifestyle Considerations

The rent vs. buy decision is also about your lifestyle.

Pros of Buying

- Stability: You have a permanent home and don't have to worry about a landlord selling the property.

- Freedom: You can renovate and decorate your home however you like.

- Building Wealth: You're paying into an asset that can grow in value over time.

Pros of Renting

- Flexibility: It's easy to move for a new job or to a new city.

- Lower Upfront Costs: You don't need a large down payment.

- No Maintenance: The landlord is responsible for all repairs.

The Final Verdict

So, what's the right choice? Buying in St. John's is tough to get into but offers a great chance to build wealth long-term. Renting is flexible but expensive, and you miss out on property value growth. If you plan to stay for more than 5-7 years, buying is likely the smarter financial move. If you have questions, feel free to contact us.

Recommendations by Profile

1. For the Long-Term Resident (Family)

Verdict: Buy.

Why: It provides stability for your family and is a solid long-term investment. Consider a two-apartment home to have rental income help with the mortgage.

2. For the Financially-Minded Investor

Verdict: Buy.

Why: The market conditions—low supply and high demand—make St. John's a great place to invest in real estate. A two-apartment home is an ideal investment tool here. Just remember that securing financing for an investment property typically requires a minimum down payment of 20%.

3. For the Young Professional

Verdict: Rent (for now).

Why: If you're not sure you'll stay in St. John's for more than five years, renting offers the flexibility you need. The costs of buying and selling a home quickly would erase any short-term gains.

4. For the Newcomer to Canada

Verdict: Rent first, then buy.

Why: Rent for a year or two to build a Canadian credit history and get to know the city with our St. John's Neighbourhood Guide. Then, aim to buy to start building wealth in this growing market.

Ready to Take the Next Step?

Getting pre-approved is the first, most empowering step on your journey to homeownership. It replaces uncertainty with clarity and confidence.

Leave A Comment